Intravascular Photoacoustic Imaging Systems in 2025: Transforming Cardiovascular Imaging with Precision and Innovation. Explore Market Trends, Breakthrough Technologies, and the Road Ahead.

- Executive Summary: Key Insights and 2025 Outlook

- Market Size, Growth Projections, and Forecasts Through 2029

- Technological Innovations and R&D Pipelines

- Competitive Landscape: Leading Companies and Strategic Initiatives

- Clinical Applications and Evolving Use Cases

- Regulatory Environment and Standards (e.g., FDA, ISO)

- Adoption Barriers and Market Drivers

- Emerging Trends: AI Integration and Multimodal Imaging

- Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

- Future Outlook: Opportunities, Challenges, and Strategic Recommendations

- Sources & References

Executive Summary: Key Insights and 2025 Outlook

Intravascular photoacoustic (IVPA) imaging systems are emerging as a transformative technology in the field of cardiovascular diagnostics, offering real-time, high-resolution visualization of vascular structures and plaque composition. As of 2025, the sector is characterized by rapid technological advancements, increased clinical validation, and growing interest from both established medical device manufacturers and innovative startups.

Key players in the IVPA imaging space include Philips, which has a strong presence in intravascular imaging through its Volcano subsidiary, and is actively exploring hybrid modalities that combine photoacoustic and ultrasound imaging. Siemens Healthineers and GE HealthCare are also investing in research and development of advanced vascular imaging platforms, with a focus on integrating photoacoustic capabilities into their existing product lines. Additionally, companies such as ENDRA Life Sciences are pioneering photoacoustic imaging technologies, although their primary focus has been on non-invasive applications, their expertise is contributing to the broader ecosystem.

Recent years have seen significant milestones, including successful preclinical and early clinical studies demonstrating the ability of IVPA systems to differentiate lipid-rich plaques from fibrous tissue, a critical factor in assessing cardiovascular risk. The integration of IVPA with intravascular ultrasound (IVUS) is a notable trend, enabling comprehensive assessment of both structural and compositional features of arterial walls. This hybrid approach is expected to enhance diagnostic accuracy and guide interventional procedures more effectively.

In 2025, the market outlook for IVPA imaging systems is optimistic, driven by the rising prevalence of cardiovascular diseases and the demand for more precise diagnostic tools. Regulatory pathways are becoming clearer, with several systems advancing through clinical trials and seeking approvals in major markets. Collaborations between academic institutions, industry leaders, and clinical centers are accelerating the translation of IVPA technology from bench to bedside.

Looking ahead, the next few years are likely to witness the commercialization of the first generation of IVPA imaging catheters, broader adoption in research and clinical settings, and further integration with artificial intelligence for automated image analysis. As the technology matures, it is poised to play a pivotal role in personalized cardiovascular care, offering clinicians unprecedented insights into vascular health and disease.

Market Size, Growth Projections, and Forecasts Through 2029

The global market for intravascular photoacoustic (IVPA) imaging systems is in an early but dynamic phase, with significant growth anticipated through 2029. IVPA imaging, which combines optical and ultrasound modalities to visualize vascular structures and plaque composition, is gaining traction as a next-generation tool for cardiovascular diagnostics. As of 2025, the market remains relatively niche compared to established intravascular ultrasound (IVUS) and optical coherence tomography (OCT) systems, but recent technological advances and clinical validation are accelerating its adoption.

Key industry players are driving innovation and commercialization. Sihuan Pharmaceutical Holdings Group and its subsidiary Medprin Regenerative Medical Technologies have been active in developing hybrid IVPA/IVUS catheters, targeting both research and clinical applications. SonoScape Medical Corp. and Philips are also exploring photoacoustic technologies, leveraging their established presence in intravascular imaging to evaluate integration with existing platforms. Meanwhile, Leica Microsystems and Olympus Corporation are investing in advanced optical components and miniaturized laser sources, which are critical for the next generation of IVPA systems.

Market size estimates for 2025 suggest a global valuation in the low hundreds of millions USD, with annual growth rates projected in the 15–25% range through 2029. This expansion is fueled by increasing demand for precise plaque characterization in coronary artery disease, ongoing clinical trials, and regulatory progress in the US, EU, and Asia-Pacific regions. The integration of IVPA with IVUS and OCT in hybrid catheters is expected to be a key growth driver, as it offers comprehensive diagnostic information in a single procedure.

Geographically, North America and Europe are leading in early adoption, supported by robust healthcare infrastructure and active clinical research. However, significant growth is anticipated in China and Japan, where government initiatives and investments in cardiovascular imaging are accelerating market entry and local manufacturing.

Looking ahead, the market outlook through 2029 is optimistic. As more IVPA systems receive regulatory clearance and enter routine clinical use, the addressable market is expected to expand beyond academic and research centers to mainstream hospitals and cardiology clinics. Strategic partnerships between device manufacturers, academic institutions, and healthcare providers will likely shape the competitive landscape, with a focus on improving image resolution, catheter flexibility, and workflow integration.

In summary, the intravascular photoacoustic imaging systems market is poised for robust growth over the next several years, driven by technological innovation, expanding clinical evidence, and increasing demand for advanced cardiovascular diagnostics. Key industry stakeholders such as Philips, Olympus Corporation, and Sihuan Pharmaceutical Holdings Group are expected to play pivotal roles in shaping the market’s trajectory through 2029.

Technological Innovations and R&D Pipelines

Intravascular photoacoustic (IVPA) imaging systems are at the forefront of cardiovascular diagnostics, offering the unique ability to visualize both the structural and molecular composition of arterial walls. As of 2025, the field is witnessing a surge in technological innovation, with several companies and research institutions advancing the capabilities and clinical readiness of IVPA systems.

A major focus in current R&D pipelines is the miniaturization and integration of photoacoustic and ultrasound modalities into a single catheter-based device. This dual-modality approach enables simultaneous acquisition of high-resolution anatomical and functional data, which is critical for identifying lipid-rich plaques and assessing their vulnerability. Companies such as Siemens Healthineers and Philips are actively developing hybrid intravascular imaging platforms, leveraging their expertise in ultrasound and optical technologies to push the boundaries of catheter design and signal processing.

Recent years have seen significant progress in laser technology, a core component of IVPA systems. The trend is toward compact, high-repetition-rate lasers that can be integrated into clinical workflows. For example, LEONI Medical is known for its development of medical-grade fiber lasers, which are being adapted for use in next-generation IVPA catheters. These advances are expected to improve imaging speed and depth, making real-time, in vivo imaging more feasible in the catheterization lab.

Another area of innovation is the development of advanced signal processing algorithms and artificial intelligence (AI) tools to enhance image reconstruction and interpretation. Companies like GE HealthCare are investing in AI-driven solutions that can automatically identify and quantify plaque components, potentially reducing operator dependency and improving diagnostic accuracy.

Collaborations between industry and academia are accelerating the translation of IVPA technology from bench to bedside. For instance, partnerships with leading cardiovascular research centers are enabling clinical feasibility studies and early-stage human trials, which are crucial for regulatory approval and eventual commercialization. The next few years are expected to see the first multicenter clinical trials of IVPA systems, with a focus on demonstrating safety, efficacy, and added value over existing intravascular imaging modalities.

Looking ahead, the outlook for IVPA imaging systems is promising. With ongoing investments in miniaturization, laser technology, and AI integration, the sector is poised for breakthroughs that could redefine the standard of care in coronary artery disease management. As regulatory pathways become clearer and clinical evidence accumulates, the adoption of IVPA systems in interventional cardiology is likely to accelerate, potentially within the next three to five years.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape for intravascular photoacoustic (IVPA) imaging systems in 2025 is characterized by a small but dynamic group of companies and research-driven organizations, each leveraging proprietary technologies to advance the clinical translation of this hybrid imaging modality. IVPA imaging, which combines the molecular sensitivity of photoacoustics with the structural detail of intravascular ultrasound (IVUS), is being positioned as a next-generation tool for the assessment of atherosclerotic plaques and vascular health.

Among the most prominent players is Siemens Healthineers, which has a longstanding presence in intravascular imaging and has signaled interest in hybrid modalities. While Siemens is best known for its IVUS and optical coherence tomography (OCT) systems, the company has invested in research partnerships exploring photoacoustic integration, aiming to enhance plaque characterization and risk stratification.

Another key innovator is Philips, whose subsidiary Spectranetics has a strong IVUS portfolio. Philips has been involved in collaborative research projects with academic institutions to develop IVPA systems that can be integrated into existing catheter platforms, with a focus on real-time, high-resolution imaging of lipid-rich plaques. The company’s strategic initiatives include partnerships with clinical centers to validate the diagnostic value of IVPA in preclinical and early clinical studies.

Emerging companies are also shaping the field. ENDRA Life Sciences is notable for its expertise in photoacoustic technology, although its primary focus has been on non-invasive applications. However, ENDRA’s technical advancements in laser and acoustic transducer miniaturization are relevant to the development of intravascular systems, and the company has signaled openness to strategic collaborations in the cardiovascular space.

Academic spin-offs and research consortia, such as those associated with the National Institutes of Health and leading universities, continue to play a pivotal role in prototype development and early-stage clinical validation. These groups often collaborate with industry partners to accelerate regulatory pathways and commercialization.

Looking ahead, the competitive landscape is expected to intensify as clinical data from ongoing trials become available and as regulatory frameworks for hybrid imaging devices mature. Strategic initiatives in the next few years will likely focus on miniaturization, catheter integration, and workflow compatibility with existing intravascular imaging suites. Companies with established distribution networks and experience in regulatory approval, such as Siemens Healthineers and Philips, are well-positioned to lead initial market entry, while innovative startups and academic partnerships will continue to drive technological breakthroughs and niche applications.

Clinical Applications and Evolving Use Cases

Intravascular photoacoustic (IVPA) imaging systems are rapidly advancing toward clinical integration, with 2025 marking a pivotal year for their application in cardiovascular diagnostics. IVPA combines optical and ultrasound modalities to provide high-resolution, molecularly specific images of vascular structures, particularly atherosclerotic plaques. This dual-modality approach enables clinicians to assess both the morphology and composition of arterial walls, offering significant advantages over traditional intravascular ultrasound (IVUS) and optical coherence tomography (OCT).

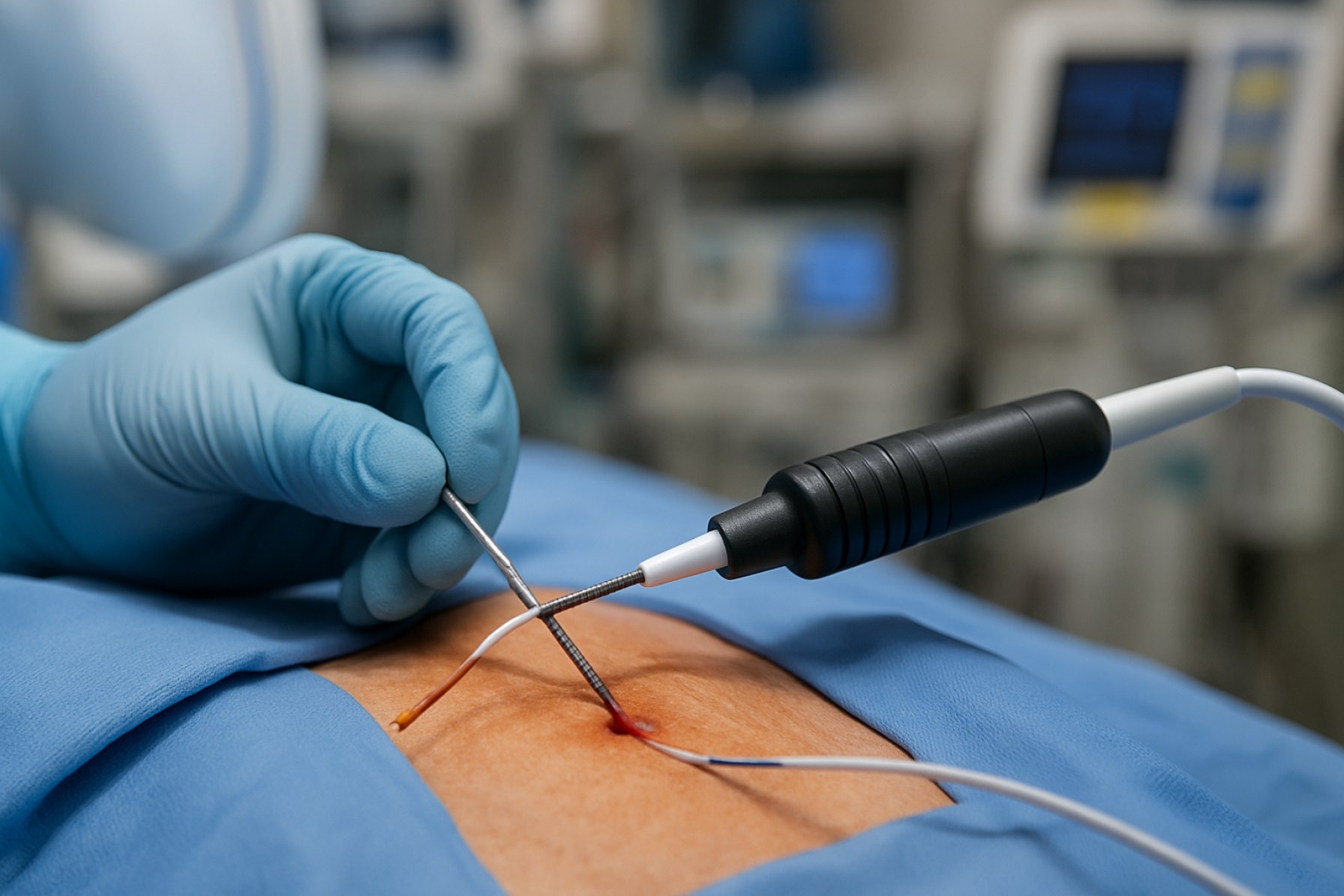

The primary clinical application of IVPA imaging is the characterization of vulnerable plaques, especially those rich in lipids, which are prone to rupture and cause acute coronary syndromes. Recent pilot studies and early-stage clinical trials have demonstrated the ability of IVPA systems to differentiate lipid-rich plaques from fibrous or calcified tissues in vivo, a capability that could transform risk stratification and treatment planning for coronary artery disease. In 2025, several academic and industry collaborations are focusing on refining catheter designs to improve flexibility, miniaturization, and imaging speed, making the technology more suitable for routine clinical use.

Key industry players are accelerating the translation of IVPA from research to clinical settings. Siemens Healthineers and Philips, both leaders in intravascular imaging, are reported to be exploring the integration of photoacoustic capabilities into their existing IVUS and OCT platforms. Meanwhile, specialized companies such as ENDRA Life Sciences are advancing photoacoustic imaging technologies, with a focus on clinical validation and regulatory pathways. These efforts are supported by collaborations with leading cardiovascular research centers and hospitals, aiming to generate robust clinical evidence for regulatory approval and adoption.

Beyond coronary imaging, IVPA systems are being evaluated for peripheral artery disease, carotid artery assessment, and even for guiding interventions such as stent placement and atherectomy. The ability to visualize plaque composition in real time could enable more precise and personalized therapies, reducing the risk of complications and improving long-term outcomes. In the next few years, ongoing clinical studies are expected to provide critical data on the safety, efficacy, and cost-effectiveness of IVPA-guided interventions.

Looking ahead, the outlook for IVPA imaging is promising. As device miniaturization, laser safety, and real-time data processing continue to improve, IVPA is poised to become a routine tool in interventional cardiology. The next wave of clinical trials and regulatory submissions, anticipated between 2025 and 2027, will likely determine the pace of widespread adoption and reimbursement, setting the stage for IVPA to play a central role in the management of vascular disease.

Regulatory Environment and Standards (e.g., FDA, ISO)

The regulatory environment for intravascular photoacoustic (IVPA) imaging systems is evolving rapidly as these devices move closer to clinical adoption. In 2025, the primary regulatory frameworks governing IVPA systems are those established by the U.S. Food and Drug Administration (FDA) and the International Organization for Standardization (ISO). These frameworks are designed to ensure the safety, efficacy, and quality of medical imaging devices, including those that combine optical and acoustic modalities.

In the United States, IVPA systems are generally classified as Class II or Class III medical devices, depending on their intended use and risk profile. Manufacturers seeking FDA clearance must typically submit a 510(k) premarket notification or, for novel devices, a Premarket Approval (PMA) application. The FDA evaluates these submissions based on compliance with standards such as IEC 60601 for electrical safety, ISO 10993 for biocompatibility, and specific guidance for ultrasound and optical imaging systems. As of 2025, no IVPA system has yet received full FDA approval for routine clinical use, but several companies are engaged in preclinical and early clinical studies, working closely with the agency to define appropriate regulatory pathways.

Globally, ISO standards play a critical role in harmonizing requirements for medical device safety and performance. ISO 13485 certification for quality management systems is a prerequisite for most manufacturers entering regulated markets. Additionally, standards such as ISO 14971 for risk management and IEC 62304 for medical device software lifecycle processes are increasingly relevant as IVPA systems integrate advanced software and artificial intelligence for image analysis.

Key industry players, including Philips and Siemens Healthineers, have established expertise in intravascular imaging and are actively monitoring regulatory developments to inform their R&D and commercialization strategies. Emerging companies and academic spin-offs are also engaging with regulatory bodies to shape the development of standards specific to photoacoustic imaging, which currently borrows heavily from existing ultrasound and optical imaging regulations.

Looking ahead, the next few years are expected to see increased collaboration between manufacturers, regulatory agencies, and standards organizations to address the unique challenges of IVPA systems, such as laser safety, catheter sterility, and real-time data processing. The establishment of dedicated working groups within ISO and the FDA’s Center for Devices and Radiological Health (CDRH) is anticipated, aiming to develop guidance documents and performance benchmarks tailored to photoacoustic technologies. This evolving regulatory landscape will be crucial in facilitating the safe and effective clinical translation of IVPA imaging systems.

Adoption Barriers and Market Drivers

Intravascular photoacoustic (IVPA) imaging systems are emerging as a promising modality for the assessment of vascular pathology, particularly for the characterization of atherosclerotic plaques. As of 2025, the adoption of IVPA imaging in clinical and research settings is shaped by a complex interplay of technological, regulatory, and market factors.

Adoption Barriers

- Technical Complexity and Integration: IVPA systems require the integration of high-frequency ultrasound with pulsed laser sources, demanding precise synchronization and miniaturization for intravascular use. The development of robust, catheter-based devices that can be safely navigated within coronary arteries remains a significant engineering challenge. Companies such as Philips and Canon, both established in intravascular ultrasound (IVUS), are yet to commercialize IVPA systems, reflecting the technical hurdles in transitioning from research prototypes to clinical-grade devices.

- Regulatory Pathways: The lack of established regulatory frameworks for photoacoustic imaging devices slows market entry. Unlike IVUS or optical coherence tomography (OCT), IVPA systems must demonstrate not only safety and efficacy but also clear clinical benefit over existing modalities. This process is resource-intensive and time-consuming, with few companies having initiated formal regulatory submissions as of 2025.

- Cost and Reimbursement: The high cost of laser components and the need for specialized disposables contribute to elevated system prices. Without established reimbursement codes, hospitals and clinics face financial disincentives to adopt IVPA technology, further limiting its diffusion.

- Clinical Validation: While preclinical studies have demonstrated the potential of IVPA for lipid core detection and plaque characterization, large-scale, multicenter clinical trials are still in early stages. The absence of robust clinical outcome data hinders physician confidence and slows adoption.

Market Drivers

- Unmet Clinical Need: There is a growing demand for imaging modalities that can accurately identify vulnerable plaques and guide interventional strategies. IVPA’s ability to provide molecular and compositional information, beyond the structural data of IVUS or OCT, positions it as a valuable tool for precision cardiology.

- Technological Advances: Recent progress in miniaturized laser sources, fiber optics, and catheter design is accelerating the development of clinically viable IVPA systems. Academic-industry collaborations, such as those involving Siemens Healthineers and leading research institutions, are expected to yield prototype systems suitable for first-in-human studies within the next few years.

- Synergy with Existing Modalities: The potential for hybrid IVPA/IVUS or IVPA/OCT systems offers a compelling value proposition, leveraging existing clinical workflows and infrastructure. Companies with established cardiovascular imaging portfolios, including Boston Scientific, are well positioned to integrate IVPA into their product lines once technical and regulatory milestones are met.

- Research Funding and Strategic Partnerships: Increased investment from both public agencies and private sector players is fueling innovation. Strategic partnerships between device manufacturers and academic centers are expected to accelerate clinical translation and market readiness.

Looking ahead, the pace of IVPA adoption will depend on continued technological refinement, successful clinical validation, and the establishment of clear regulatory and reimbursement pathways. The next few years are likely to see the first commercial pilot deployments, setting the stage for broader market entry by the late 2020s.

Emerging Trends: AI Integration and Multimodal Imaging

Intravascular photoacoustic (IVPA) imaging systems are at the forefront of cardiovascular diagnostics, offering high-resolution, molecular-level visualization of arterial walls and plaque composition. As of 2025, the field is witnessing a significant shift toward the integration of artificial intelligence (AI) and multimodal imaging, aiming to enhance diagnostic accuracy, workflow efficiency, and clinical adoption.

AI integration is rapidly transforming IVPA imaging. Advanced machine learning algorithms are being developed to automate image reconstruction, noise reduction, and feature extraction, enabling real-time interpretation of complex photoacoustic signals. This is particularly relevant for identifying vulnerable plaques and differentiating lipid-rich cores from fibrous tissue. Companies such as Siemens Healthineers and Philips—both established leaders in medical imaging—are investing in AI-driven solutions that can be adapted to IVPA platforms, leveraging their expertise in deep learning and image analytics. These efforts are expected to reduce operator dependency and improve reproducibility, addressing a key barrier to widespread clinical use.

Multimodal imaging is another major trend, with IVPA systems increasingly being combined with intravascular ultrasound (IVUS) and optical coherence tomography (OCT). This hybrid approach provides complementary information: IVUS offers structural detail, OCT delivers high-resolution surface imaging, and IVPA supplies molecular and compositional data. Companies like Intravascular Imaging, Inc. and Boston Scientific are actively exploring such multimodal catheters, aiming to deliver comprehensive assessments of coronary artery disease in a single procedure. Early clinical studies and pre-commercial prototypes have demonstrated the feasibility of these systems, with ongoing trials expected to yield pivotal data in the next few years.

Looking ahead, the convergence of AI and multimodal imaging is anticipated to drive the next wave of innovation in IVPA systems. Automated plaque characterization, real-time risk stratification, and personalized treatment planning are within reach as algorithms become more sophisticated and datasets expand. Regulatory pathways are also evolving, with agencies such as the FDA showing increased openness to AI-enabled diagnostic devices, potentially accelerating market entry for new IVPA solutions.

In summary, 2025 marks a pivotal year for intravascular photoacoustic imaging, with AI integration and multimodal approaches poised to redefine the landscape. As industry leaders and emerging innovators continue to collaborate, the coming years are likely to see IVPA systems transition from research settings to routine clinical practice, offering unprecedented insights into vascular health.

Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

The regional landscape for intravascular photoacoustic (IVPA) imaging systems is evolving rapidly, with North America, Europe, and Asia-Pacific emerging as key hubs for research, development, and early clinical adoption. As of 2025, these regions are witnessing distinct trends shaped by healthcare infrastructure, regulatory environments, and the presence of leading technology developers.

North America remains at the forefront of IVPA imaging innovation, driven by robust investment in cardiovascular research and a strong ecosystem of medical device companies. The United States, in particular, benefits from a concentration of academic medical centers and collaborations between universities and industry. Companies such as Sigenics, Inc. and Spectrasonics, Inc. are actively involved in the development of advanced photoacoustic imaging components and systems. The region’s regulatory clarity, with the U.S. Food and Drug Administration (FDA) providing pathways for novel imaging modalities, is expected to accelerate clinical trials and early commercialization over the next few years.

Europe is also a significant player, with a focus on translational research and multi-center clinical studies. The European Union’s support for cross-border research initiatives and harmonized medical device regulations (MDR) is fostering collaboration among academic institutions and industry. Notable contributors include Philips, which maintains a strong presence in cardiovascular imaging and is exploring hybrid imaging modalities, and Siemens Healthineers, which is investing in next-generation intravascular imaging technologies. European hospitals are increasingly participating in pilot studies, and the region is expected to see expanded clinical validation and early adoption of IVPA systems by 2026.

Asia-Pacific is experiencing rapid growth, propelled by rising cardiovascular disease prevalence and expanding healthcare infrastructure. Countries such as China and Japan are investing heavily in medical imaging innovation. Companies like Olympus Corporation are leveraging their expertise in endoscopic and intravascular devices to explore photoacoustic applications. Additionally, academic-industry partnerships in the region are accelerating the translation of IVPA prototypes into clinical settings. Regulatory agencies in Asia-Pacific are increasingly receptive to novel imaging technologies, suggesting a favorable outlook for market entry and adoption in the coming years.

Beyond these regions, emerging markets in Latin America and the Middle East are beginning to show interest in advanced intravascular imaging, though adoption is currently limited by infrastructure and regulatory challenges. However, as global awareness of IVPA’s potential for early atherosclerosis detection and plaque characterization grows, these regions may become important markets in the latter half of the decade.

Overall, the next few years are expected to bring increased clinical validation, regulatory progress, and early commercialization of intravascular photoacoustic imaging systems, with North America, Europe, and Asia-Pacific leading the way.

Future Outlook: Opportunities, Challenges, and Strategic Recommendations

The future outlook for intravascular photoacoustic (IVPA) imaging systems in 2025 and the coming years is shaped by rapid technological advancements, evolving clinical needs, and strategic industry initiatives. IVPA imaging, which combines optical and ultrasound modalities to visualize vascular structures and plaque composition, is increasingly recognized for its potential to address unmet needs in cardiovascular diagnostics.

Key opportunities are emerging as IVPA systems move closer to clinical translation. Several companies are actively developing and refining IVPA platforms. Siemens Healthineers and Philips—both global leaders in medical imaging—have ongoing research and development in hybrid intravascular imaging, including photoacoustic modalities. Startups and academic spin-offs, such as ENDRA Life Sciences, are also contributing to the innovation pipeline, focusing on miniaturization, catheter integration, and real-time imaging capabilities.

In 2025, the primary drivers for IVPA adoption are expected to be the growing prevalence of atherosclerotic cardiovascular disease and the demand for more precise, composition-specific imaging of arterial plaques. IVPA’s ability to differentiate lipid-rich from fibrous plaques offers a significant advantage over conventional intravascular ultrasound (IVUS) and optical coherence tomography (OCT), potentially enabling more personalized and effective interventions.

However, several challenges remain. Technical hurdles include the need for further miniaturization of IVPA catheters to ensure compatibility with existing interventional workflows, as well as improvements in laser safety, imaging speed, and data processing. Regulatory pathways are also complex, as IVPA systems must demonstrate clear clinical benefit and safety in large-scale trials before widespread adoption. Companies like Boston Scientific and Abbott, with established cardiovascular device portfolios, are well-positioned to integrate IVPA technology, but must navigate these regulatory and technical barriers.

Strategic recommendations for stakeholders include fostering collaborations between device manufacturers, academic institutions, and clinical partners to accelerate validation and adoption. Investment in robust clinical studies will be critical to demonstrate the added value of IVPA imaging in guiding interventions and improving patient outcomes. Additionally, companies should prioritize user-friendly system design and seamless integration with existing cath lab infrastructure to facilitate clinical uptake.

Looking ahead, the IVPA imaging sector is poised for significant growth, with the potential to transform intravascular diagnostics and therapy. Success will depend on continued innovation, strategic partnerships, and clear demonstration of clinical and economic benefits.

Sources & References

- Philips

- Siemens Healthineers

- GE HealthCare

- ENDRA Life Sciences

- Sihuan Pharmaceutical Holdings Group

- Medprin Regenerative Medical Technologies

- Leica Microsystems

- Olympus Corporation

- National Institutes of Health

- Canon

- Boston Scientific

- Sigenics, Inc.